ExxonMobil beat Wall Street expectations for the fourth quarter of 2025, reporting adjusted earnings per share of $1.71, beating estimates of $1.68. Despite these positive results, the company’s shares fell 2% in pre-market trading, reflecting investor caution over the pressure facing the global energy industry due to oversupplied oil.

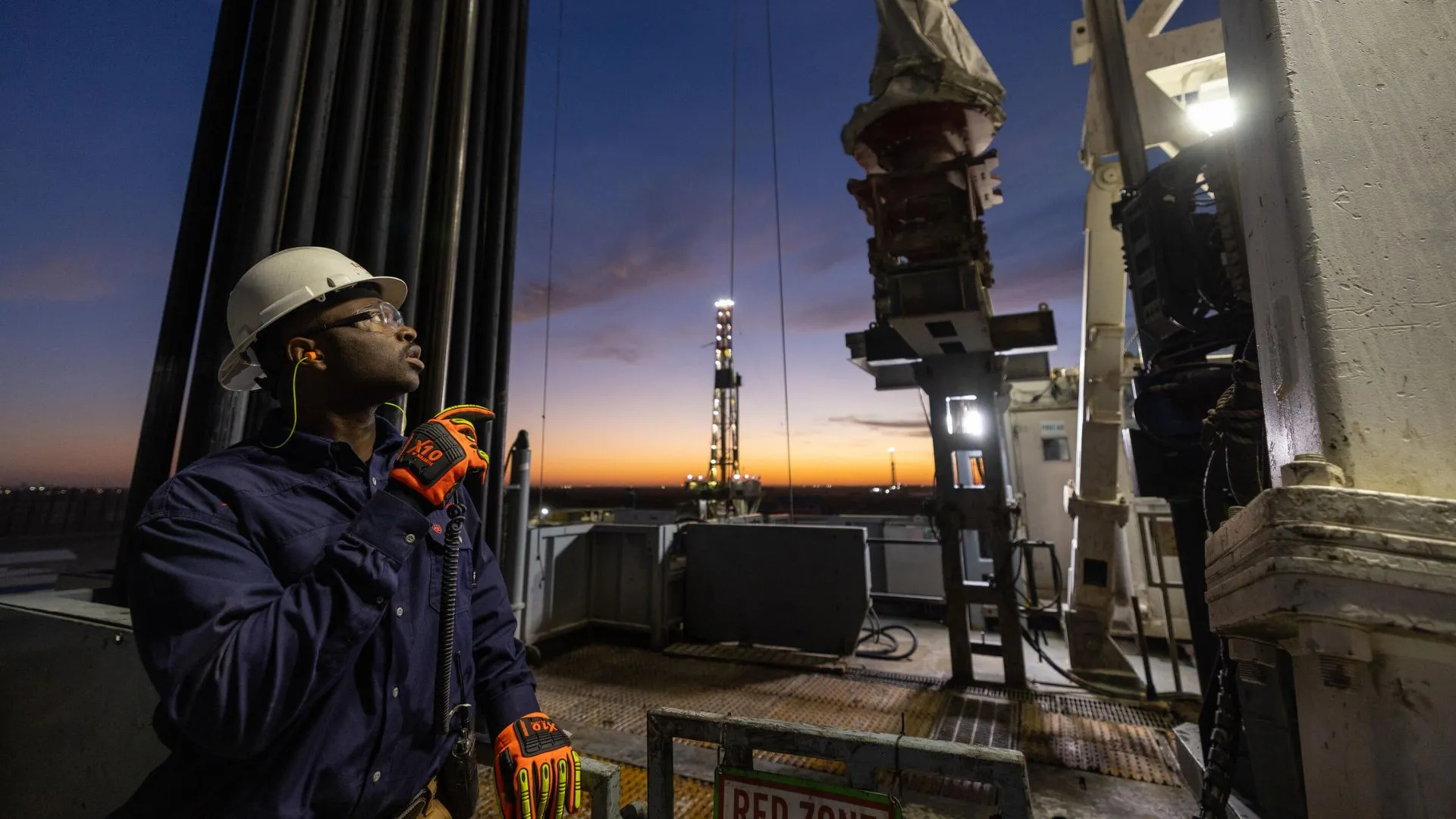

ExxonMobil production reaches record levels in more than 40 years

In a year marked by falling Brent oil prices Brent oil prices due to a saturated market, ExxonMobil prices due to a saturated market, ExxonMobil managed to maximize its production, reaching an average of 4.7 million barrels of oil equivalent per day(boepd) in 2025, the highest level in its history in more than four decades. During the fourth quarter, the company reached nearly 5 million boepd, boosted by highly profitable assets in the Permian Basin and Guyana.

We are deriving more value from every barrel and molecule we produce and creating growth platforms at scale that will ensure a profitable growth trajectory to 2030 and beyond.

Darren Woods, CEO of ExxonMobil,

ExxonMobil’s downstream segment, which covers refining, experienced a solid performance, with a 60% increase in adjusted earnings over the third quarter to US$2.9 billion. This increase was due to stronger refining margins, cost savings and record throughput at its refineries.

However, the overall result was marred by problems in the chemicals division, which reported an adjusted loss of US$11 million in the fourth quarter, compared to a profit of US$515 million in the previous quarter.

The decline was attributed to weaker margins, higher seasonal expenses and write-downs. This is the first negative result for Exxon’s chemicals segment since the fourth quarter of 2019, underscoring the challenges facing the global chemicals industry.

Despite challenges in some segments, ExxonMobil remains committed to returning value to its shareholders. The company has rewarded investors with $17.2 billion in dividends in 2025 and plans to repurchase $20 billion in shares through 2026. This share buyback strategy reflects the company’s focus on maintaining its strong financial position and attracting investors in a volatile environment.

Our strategy is designed to remain profitable even in times of volatility, with a clear focus on innovation and operational efficiency.

Woods said.

Source and photo: ExxonMobil