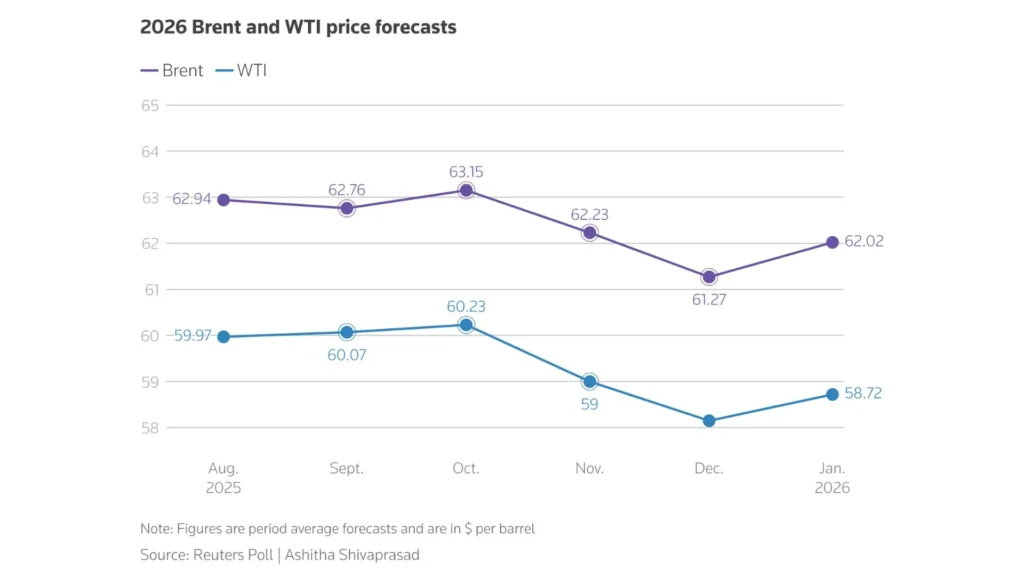

According to a recent Reuters poll, the price of oil will remain close to $60 per barrel this year. The report, which compiles the estimates of 31 economists and energy analysts, forecasts that Brent crude will average $62.02 in 2026, while WTI will be around $58.72.

This behavior is mainly explained by a structural surplus in global supply, which continues to exert pressure on prices despite the unstable geopolitical context. The market seems to have discounted the effects of the sanctions on Russia, the cross-threats between the United States and Iran and the uncertainty in the Middle East.

Noisy geopolitics, limited impact

Although political headlines dominate the narrative, their effect on actual supply has been limited. Analysts such as Norbert Ruecker of Julius Baer agree that events in Iran or Venezuela have had a limited effect on actual supply. Venezuela do not alter the structural picture: crude oil availability continues to outstrip demand.

Data indicate that the daily surplus could range from 0.75 to 3.5 million barrels. This surplus offsets any potential disruption from conflicts or sanctions. In fact, the Brent was trading at almost 70 dollars at the end of Januarya value that reflects speculative factors rather than physical market fundamentals.

Venezuela and OPEC+ under scrutiny

On the supply side, it is anticipated that Venezuela will not be able to significantly increase its production in the short term. Logistical restrictions, lack of investment and the sanctions imposed by the United States will continue to limit its export capacity.

As for the OPEC+the coalition has not yet defined adjustments beyond the first quarter of 2026. Although the group paused production increases during the first quarter, its future decisions are expected to respond to the evolution of demand, especially in Asia.

Trade uncertainty and Chinese demand

In addition to supply factors, the outlook for consumption continues to be conditioned by the economic pace in China and U.S. trade policy decisions. A sustained expansion in demand could boost prices, but the current consensus points to a balanced market with a moderate trend.

The oil market The oil market in 2026 is shaping up to be a scenario of controlled prices. The balance between an abundant supply and a still fragile demand seems to tilt the balance towards stable values, with contained fluctuations. Barring unexpected external shocks, the barrel will continue to hover around 60 dollars.

Source and internal photo: Reuters

Main photo: Shutterstock