OPEC+ crude oil production remained at around 29 million barrels per day during November, reflecting a stability that, far from reassuring the market, accentuates the outlook for oil supply and prices.

The group has decided to pause the reduction of production cuts for the next quarter, which adds additional pressure on prices. At the same time, the US sanctions imposed on state-owned companies in Russia and Venezuela have influenced prices, which remained close to 60 dollars per barrel WTI during most of the last quarter.

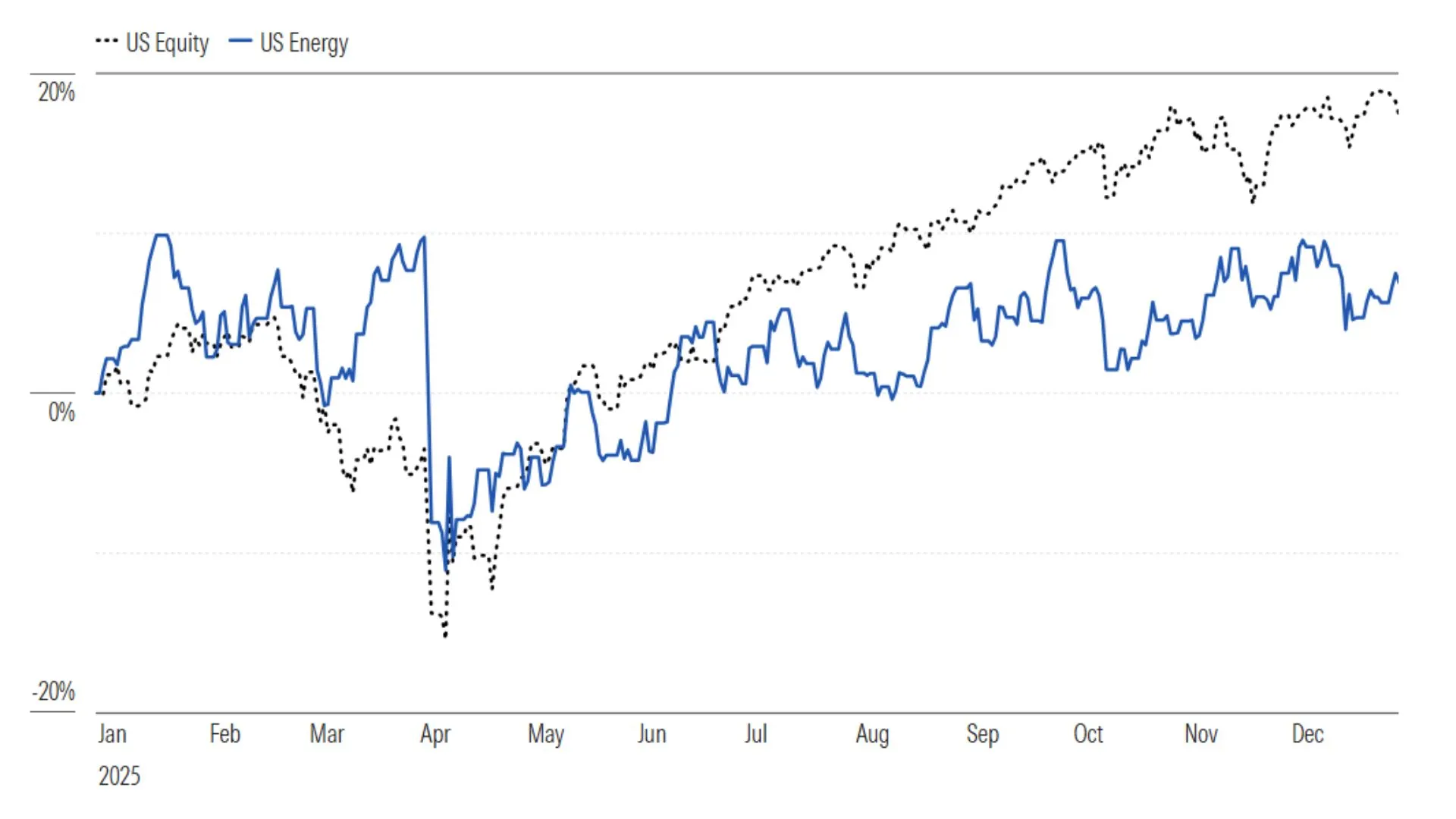

Market anticipates a drop in oil prices

Analysts from firms such as Morningstar and Rystad Energy agree that the market has discounted the main risks, including political instability in Venezuela. The conclusion is clear: the solid supply available will comfortably cover seasonal demand, which opens the door to a possible oversupply scenario. In fact, it is estimated that the surplus could reach 1 million barrels per day by the end of this year and expand in the first months of 2026. This would cause WTI to fall below $55 per barrel.

In the face of these bearish signals, investors are focusing on companies with advantages in operating efficiency. In this context, SLB and Diamondback stand out for their strategic positioning and cost control. SLB, with a strong offshore presence outside North America, has a project portfolio that could exceed US$100 billion in potential revenues. In addition, its digital business is projected to double revenues by the end of 2025, reaching US$3 billion.

The Permian area remains the epicenter of drilling in the United States. Although the number of wells drilled but incomplete has declined, a progressive recovery is observed through stronger market fundamentals. In this environment, companies such as Diamondback are consolidating a strategy based on smart acquisitions and low-cost production, taking advantage of the concentration of quality assets in that region.

Devon Energy benefits from strong cash flow generation, supported by favorable tax policies and efficient productive assets. In addition, its projected 14% return on free cash flow by 2025 and its share buyback policy make it an attractive option. Diamondback, on the other hand, has been able to consolidate a prominent position in the Permico upstream thanks to its efficient capital allocation. Finally, SLB stands out as one of the cheapest options in the market, with sufficient technological capacity and scale to face the cyclical headwinds ahead.

Source and photo: Morningstar