The development of any large-scale hydrogen project requires multi-million dollar investments. Financiers demand certainty before committing massive funds to a still-nascent market, and despite some positive results, it is still viewed with reservations. This certainty is materialized through a contractual tool: the Offtake Agreement (Long-Term Purchase Agreement).

Hydrogen has become a source of hope for decarbonization in the coming years. It has established itself as an essential energy vector for sectors ranging from maritime transport to fertilizer and steel production (IEA, 2024). However, global ambitions are measured in gigawatts of electrolysis capacity and millions of tons of production. However, between technological enthusiasm and the start of construction of an industrial-scale green hydrogen plant, there is a monumental obstacle: the lack of secure long-term demand.

The following lines will explore the definition, financial viability, and pricing mechanisms of these agreements, demonstrating why they are, without exaggeration, the legal foundation that enables the construction of the new hydrogen economy.

The contractual architecture of viability

What is an Offtake Agreement in a hydrogen project?

Far from being a simple purchase order, an Offtake Agreement in the hydrogen sector is a long-term hydrogen sales contract, generally lasting between 15 and 20 years, between the producer (seller) and the consumer (buyer or offtaker) (Smith & Jones, 2025). This document obligates the buyer to acquire a predefined quantity, or a percentage, of the hydrogen output produced by the facility, even if future spot market prices fall below the agreed value.

This legal commitment plays a fundamental role in mitigating the so-called buyer risk, meaning the uncertainty of who will purchase the product once it becomes available. In this way, an offtake agreement becomes, in essence, a financial guarantee that developers can present to their lenders. Without such an agreement backed by a solid and reliable company, project financing through debt, the most common mechanism for large-scale infrastructure, becomes nearly impossible to secure. Therefore, this contractual mechanism transforms hydrogen market risk into a bankable certainty.

Vitality for banking and scale

Offtake agreements are vital to hydrogen projects because of their direct impact on the bankability of the asset. The high cost of technology and the need for economies of scale dictate that hydrogen projects must operate at maximum capacity over extended periods to reduce the Levelized Cost of Hydrogen (LCOH). Under these conditions, offtake agreements become sine qua non, the bridge between technological vision and financial reality.

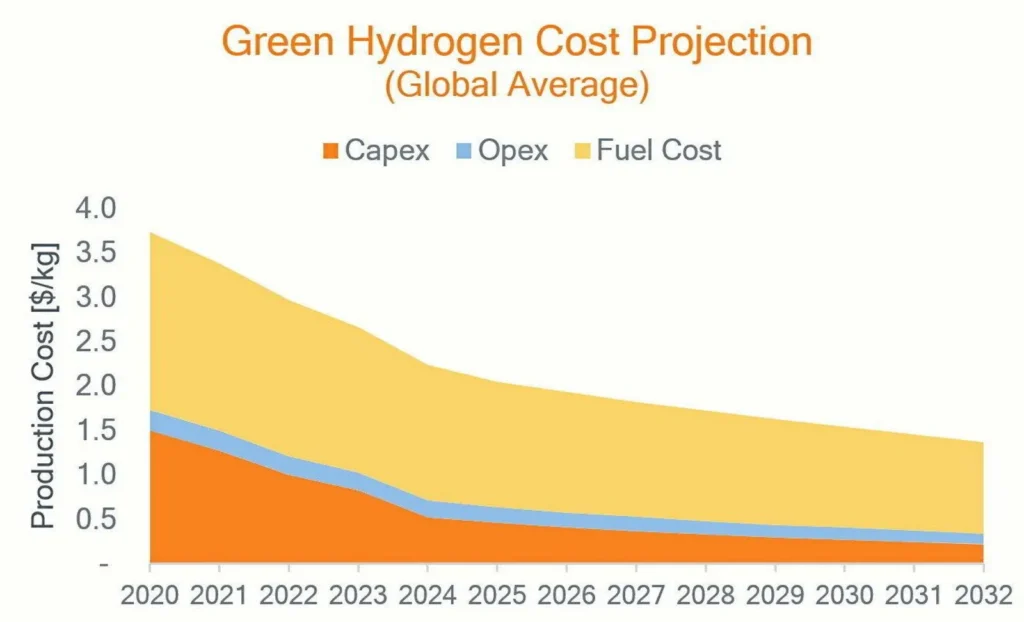

Their ability to secure predictable cash flows makes them indispensable for banks to classify a project as bankable, meaning suitable for large-scale financing. In the early development stage, when the price of green hydrogen remains high compared to gray hydrogen, a robust offtake agreement is often the sole factor enabling infrastructure construction. The contract ensures the revenue stability required for debt servicing, which in turn allows the producer to access capital at lower interest rates.

Consider the NEOM Project in Saudi Arabia, designed to produce green ammonia at an unprecedented scale. According to reliable sources, the project advanced to its Final Investment Decision (FID) only after signing a massive offtake agreement with Air Products, securing the purchase of its entire production for three decades (Al-Mansour, 2025).

This commitment enabled the project’s financing but also set a global precedent: in a nascent market filled with uncertainty, long-term contracts can transform a technological promise into a tangible financial asset with long-term benefits. While NEOM’s final performance is yet to be evaluated, its contractual structure already serves as a model for future hydrogen projects in regions where investment appetite depends on commercial certainty.

The “Green Premium”

One of the most sensitive aspects of negotiating an offtake agreement is the pricing mechanism for hydrogen. As is well known, producing hydrogen, particularly renewable hydrogen, is costly. Since there is still no mature and liquid market serving as a reference and guarantor for this new energy vector, both parties must build pricing models from scratch, often disconnected from the traditional cost structure of gray hydrogen.

This is where the concept of the “Green Premium” arises, the additional value a buyer is willing to pay for the sustainability attribute of renewable hydrogen. BloombergNEF (2024) defines it as the price differential associated with environmental performance. It might seem like an overvaluation, but it also represents the economic recognition of the decarbonization process and its contribution to achieving ESG targets.

Therefore, an offtake agreement must precisely define hydrogen certification criteria that meet sustainability standards. This includes clauses proving that the electricity used for electrolysis was renewable and generated in proximity to the plant (European Commission, 2023).

However, since the green premium alone often fails to close the cost gap, governments have intervened to ensure financial viability. Mechanisms such as Contracts for Difference (CfD) have emerged, commonly implemented through auctions in Europe, serving as a complementary tool (European Commission, Hydrogen Bank and Contracts for Difference Mechanism, 2024). If the offtake sale price falls below a reference price, or becomes unviable, the government support compensates the difference, ensuring producer profitability while maintaining a sustainable purchase price for the offtaker.

Conclusion

Oftake agreements are not a mere legal formality; they are the cornerstone that secures demand and enables the financing of large-scale hydrogen projects. By guaranteeing long-term sales, they unlock billions in investment, enable increased production, and accelerate cost reduction until parity is achieved. A solid purchase agreement is therefore the best indicator of a project’s future success and a key sign of progress toward the energy transition. In short, following these contracts is not just about analyzing legal documents, but anticipating the direction of the global energy system.

References

- Al-Mansour, H. (2025). NEOM Green Ammonia Project and Air Products Offtake Agreement. Saudi Energy Review.

- BloombergNEF. (2024). The Green Premium in Renewable Hydrogen Pricing. BloombergNEF Report.

- European Commission. (2023). Renewable Hydrogen Certification Criteria. Official Communication of the European Commission.

- European Commission. (2024). Hydrogen Bank and Contracts for Difference Mechanism. Official Communication of the European Commission.

- International Energy Agency (IEA). (2024). Global Hydrogen Review 2024. OECD/IEA Publications.

- Smith, J., & Jones, P. (2025). Long-Term Offtake Contracts in the Hydrogen Market. Journal of Energy Finance and Policy, 18(2), 45–63.

Frequently asked questions (FAQs)

What is an offtake agreement in hydrogen?

A long-term purchase contract securing demand and project financing.

Why are these contracts essential?

They guarantee revenue, reduce risk, and enable large-scale investment.

What does an offtake agreement include?

Volume, price terms, duration, green certification, and buyer obligations.

What is the “green premium” in hydrogen?

The extra price paid for renewable hydrogen that supports decarbonization.